Viopas Venture Consulting - Healthcare Innovation by Entrepreneurship

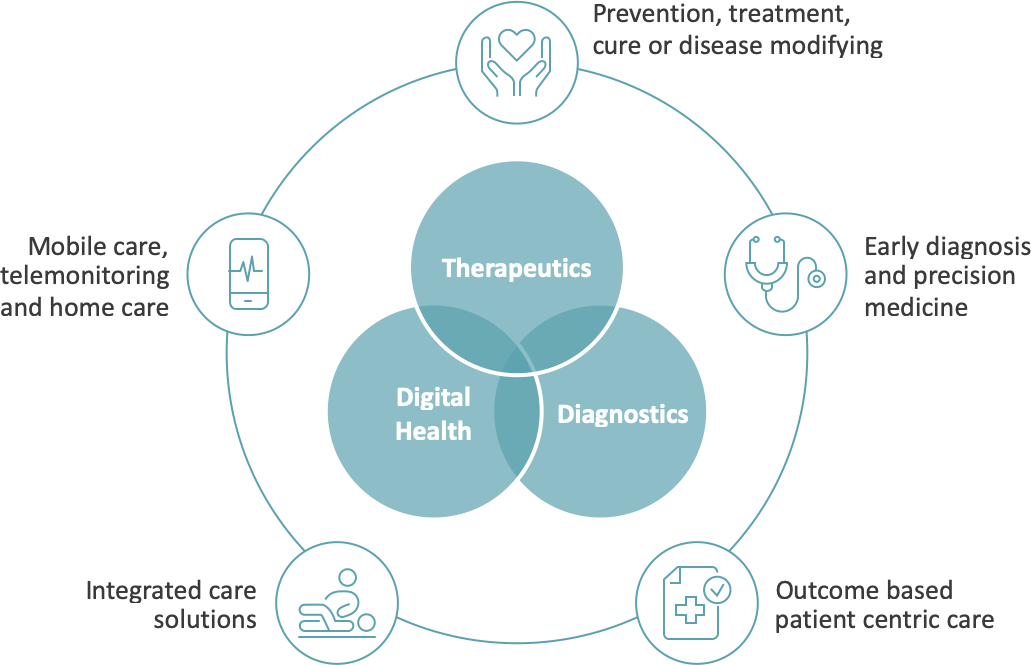

Disruptive innovation characterizes the healthcare industry where patients expect novel therapies to improve clinical and quality of life outcomes. Physicians seek earlier and better diagnosis of patients to offer innovative treatment strategies. Hospitals seek to improve their care offerings, streamline processes and reduce cost across the entire care pathway.

Viopas Venture Consulting supports

Sponsors with valuable decision criteria for investment opportunities in the Healthcare sector

Healthcare companies with a wide range of tailor-made services and advice such as fundraising, business strategy, licensing, and M&A